- Cash exchange network Coinme has partnered with digital payments platform CiNKO.

- The collaboration will enable Coinme customers to send funds to CiNKO wallets and cash out at participating MoneyGram locations in Latin America.

- Seattle, Washington-based Coinme made its Finovate debut at FinovateSpring 2022.

A collaboration between digital payments platform CiNKO and cryptocurrency cash exchange Coinme is designed to boost access to digital assets for millions around the world. Courtesy of the partnership, Coinme customers will be able to send funds to CiNKO wallets and pick up cash from participating MoneyGram outlets in Latin America and the Caribbean.

“Our collaboration with Coinme represents a pivotal step towards advancing financial inclusion and democratizing cryptocurrency access,” CiNKO Co-founder and CEO Richard Douglas said. “By leveraging our platforms, we aim to establish a more accessible, secure, and cost-effective ecosystem for users globally.”

Founded in 2016 and headquartered in Costa Rica, CiNKO innovates at the intersection of decentralized blockchains and inexpensive mobile technology to help provide banking and payment services to the unbanked and underbanked. The company offers a digital payments platform that enables cross-border transfers, payout distributions, and payment processing via traditional rails, stablecoins, and more. Available in 44 countries in Latin America and the Caribbean, the company boasts low fees, including no administrative or processing fees.

“Coinme is proud to be aligned with CiNKO in a vision that both companies share,” Coinme Co-founder and CEO Neil Bergquist said. “Our mission is to provide more individuals around the world with access to a better financial future via cryptocurrency. This partnership serves that mission and the millions of people who benefit from trusted access to cryptocurrencies.”

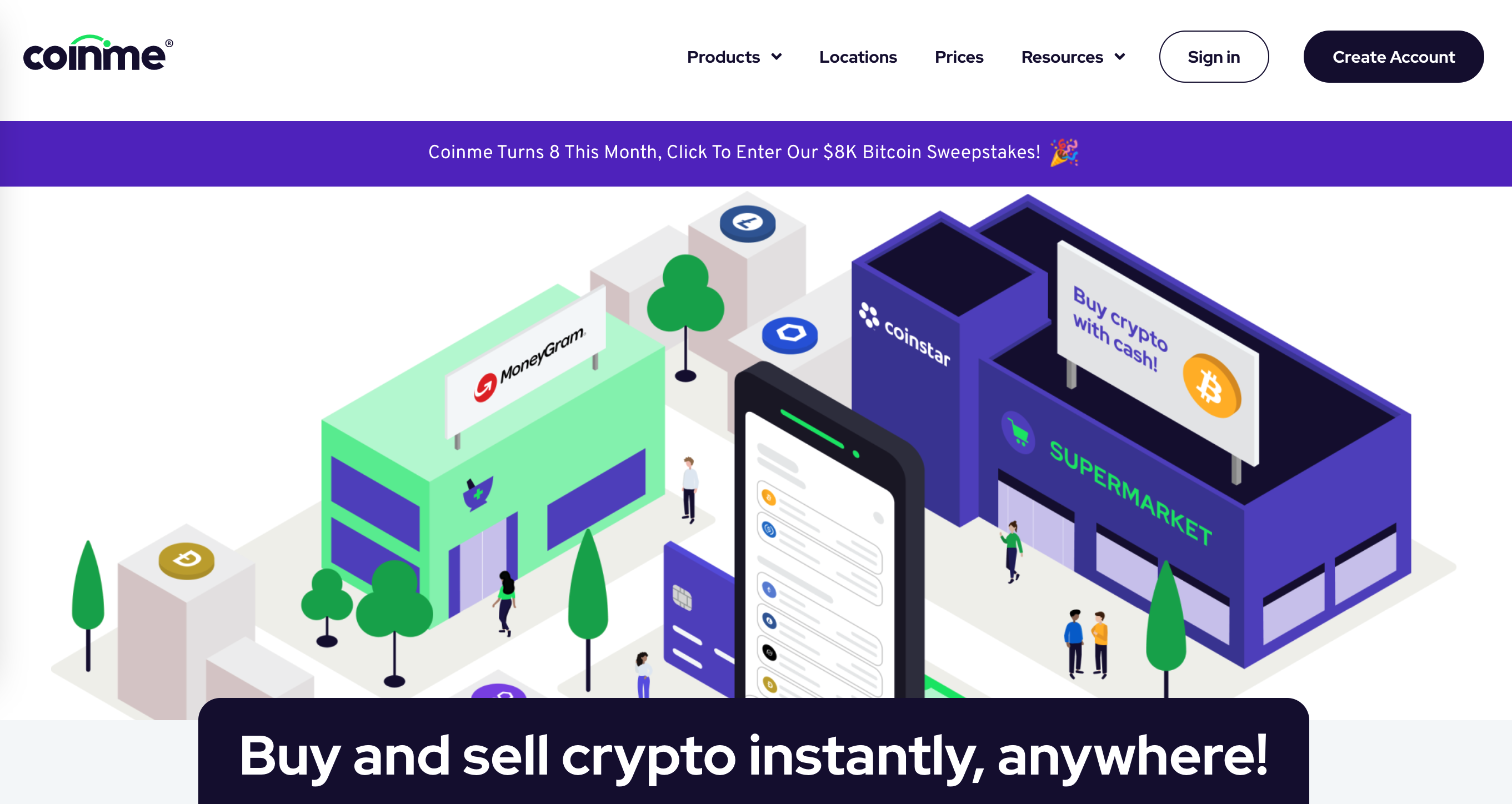

Coinme made its Finovate debut at FinovateSpring 2022 in San Francisco, California. At the conference, the company demoed its Embedded Crypto Finance solution, a crypto-as-a-service offering that “crypto-enables” fintechs and financial institutions, allowing them to add digital asset transaction and storage functionality to their platforms. Headquartered in Seattle, Washington, and founded in 2014, Coinme powers the world’s largest cash exchange, with more than 40,000 brick and mortar locations to facilitate instant transfers from cash to crypto and from crypto to cash.

Last month, Coinme introduced its latest cash-to-crypto experience. In addition to announcing new automatic fulfullment functionality via Coinme’s partnership with Coinstar, the company also announced higher purchasing limits. Users can now buy up to $9,500 in crypto daily and $60,000 in crypto monthly for cash transactions. Also in March, Coinme announced a major expansion of its cash network, adding 22,000+ ATMs to facilitate instant cash outs.